Note: This article was originally published by HomeReplay in 2011. We've re-posted it here because the core principles discussed in the article remain relevant in today's Real Estate market.

REO Investment Properties

"Which one should I buy?" By: HomeReplay, LLC

As we start the new year of 2011, it promises to be more of the same. The economy is still sluggish, unemployment remains high, and foreclosures rates are continuing to climb. The retirement accounts people have been counting on for years are now evaporating under the added strain of bad economic conditions, increased taxes and government intervention and a general malaise of the public towards the future.

Due to these factors many investors are finding it necessary to take a more active role in their investment strategies. They are no longer willing to let some "wall street" yuppie with no business experience handle their retirement accounts or more to the point, their family's future. To some investors the answer is to take a more active role in controlling their investments by becoming involved with more tangible assets, ones they can see, touch, and feel — like real estate. For these awakened investors, owning rental property can be an extremely effective way to protect their capital and generate cash flow.

If this describes you, then you may want to consider investing in real estate as the long-term hedge against the current financial disaster. When starting in real estate there are many different ways to get involved, from single family houses to multiple family apartments. Therefore you need a plan to follow when investing in real estate.

One of the better buys in today's market are bank owned properties. Know as REOs (Real Estate Owned) these properties are ones which have gone through the foreclosure process and are now owned by the bank. Since banks are not in the rental property business, these REO's (single family and apartments are available) are good sources for investors to obtain great property at even better buys. The downward spiraling economy caused by the collapse of the sub-prime mortgage loans, has given rise to a glut of foreclosed homes in every city around the country. Thus, one of the first and most important questions an investor has to answer is — "Which property should I buy?"

As you ponder this question, two more immediately pop into your mind. "How much should I pay for the property?" And — "How much are the repairs going to cost to fix the property?" All are questions you need to answer before you buy. So then — How do you go about answering these questions and how do you know if your answers are right?

The most important part of your plan is the formation of a process or methodology to follow when buying property. Aspects of this plan should include — property selection, property evaluation and reporting, cost analysis for long-term investment purposes as well as repair cost estimating and finally some estimation as to the future value of the property. These are important elements you need to include in your plan or business model before you start buying property.

So now the question becomes — "Do I have to develop this process myself or can I use an existing business model?" The answer is you can do either. If you want to take the time and effort to build your own system and experiment with several properties until you get the "kinks" worked out of the system, go ahead and do it yourself. Nothing is wrong with this approach. It has worked in the past for many and it will work for you.

If, however, you want to take advantage of the super buys caused by all the foreclosures, then you might want to try a slightly different approach and not spend your time reinventing the wheel. Use someone else's wheel (or business model) and start today being properly prepared to compete against other investors for the great buys in REO property. You will be fascinated by the range of property types, styles and condition of these REO's which range from very "high-end" homes to "starter" homes. As an investor, you will need to decide which market to pursue, the house "flipping" market or the "rental" market. No matter which market you pursue, you will need tools to help you make wise decisions about which property to buy.

|

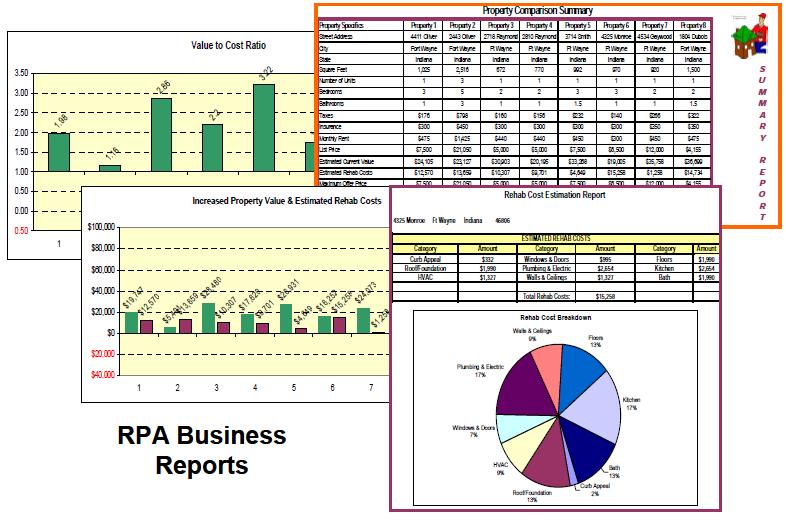

One of the best ways to achieve a stable, repeatable process for evaluating property is to have a software tool that addresses all of the issues like — Which property to buy? How much to pay for this property? What are the repair costs going to run me? And what is the expected value after repairs? These questions and more are answered by HomeReplay's exciting new software product called Rapid Property Analyzer (RPA). This software tool consists of a systematic process to help you evaluate potential property for investment purposes. By using this software the investor evaluates each property the same way using the same criteria. This approach allows the investor to identify his return on investment (ROI) using a standard set of rules for evaluating all properties. |

|

RPA contains a series of charts and graphs that enable the investor to compare up to eight properties at a time. This is an extremely valuable tool because it presents multiple properties at a time to the investor, all calculated using identical criteria and charted on the same baseline. This is one of the most unique features of RPA and provides immediate benefit to the investor making it a valuable decision making tool. |

|

In summary, Rapid Property Analyzer provides a common baseline for analyzing data on different properties. It also removes positive or negative feelings the investor has formed on the property. By using RPA reports, results can be easily compared to each other because the same assumptions were used for all calculations. Having RPA enables the new investor to draw upon a wealth of experience of seasoned investors, helping him to make better decisions right from the start. Experienced real estate investors know that time-is-of-the-essence when buying property and the faster you can make decisions, the better.

For more information visit www.homereplay.com

- Log in to post comments